Understanding the grant funding landscape in biotechnology

In this article, Dr. Fawzi Abou-Chahine, Grants Director at FI Group UK, delves into the evolving landscape of grant funding in the biotechnology sector. He highlights the significant economic impact of government grants, which have historically driven productivity, job creation, and investor confidence.

Government grants have historically stimulated significant economic growth, contributing billions in turnover for UK companies. This growth stems from productivity increases, job creation, and greater investor confidence.

However, the UK 2024 Government's grant strategy has faced substantial funding challenges, notably there was a significant absence of incentives for businesses to invest in in capital or innovation projects. To understand how the UK Government's grant strategy will change in 2025, we need to look at what happened last year.

Where does the funding go?

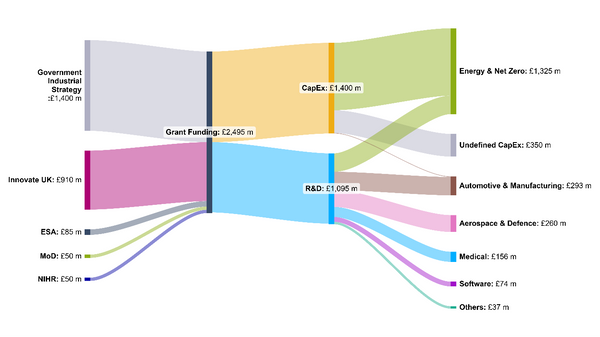

It’s helpful to understand how much the UK spends on innovation and capital expenditure grants, and its sector breakdown. On average, over the past 3 years, the wider Biotech and Medical sector received £156 million to fund R&D, and close to £50 million for large capital investments in equipment for pharmaceuticals. The bulk of the funding was directed to the strategically important sectors of advanced manufacturing, clean energy, automotive, and aerospace.

The historic flow of innovation and capital expenditure grant funding across sectors

However, the 2024 fiscal year saw at least a five-times drop in expected innovation grant funding compared to previous years. The yearly Innovate UK R&D grant investment should average around £1 billion, however initial end of year results indicate the 2024 fiscal year released only £200 million in innovation funding. The likely reason for this drop is because of the government shutdown across Q2/Q3 2024. We are beginning to see signs of funding opening up.

Innovation Grants

Looking further ahead, we expect the 2025/2026 innovation funding budget to reach towards £1 billion but focused over smaller targeted funds, with a focus on historically under-funded Regions like Northern Ireland, Scotland, and Wales; as well as strategically important sectors undergoing digitalisation such as professional services, creative industries, and healthcare.

The best competitions focused on the biotechnology startup sector include Biomedical Catalyst and the Investor Partnerships. Detailed below, these offer up to £1 million in grant funding, depending on the stage of technology in development.

There are additional funds to consider including:

- NIHR i4i (Invention for Innovation):

- Focus: Supports product development of medical devices, in vitro diagnostic devices, and digital health technologies.

- Maximum Grant: Up to £1 million.

- Eligibility: Open to SMEs, NHS organizations, and universities.

- EIC Accelerator:

- Focus: Supports innovative projects with the potential to create or disrupt markets, covering TRL 6-8 (Clinical Phases I to II).

- Maximum Grant: Up to €2.5 million in grant. (Additional equity investments up to €10 million is not available to UK applicants).

- Eligibility: Startups and SMEs, including individuals intending to launch an SME.

Capital Investment

Several funds have been released to incentivise investment in the UK's biotechnology manufacturing and supply chain capabilities. For example, the current Life Sciences Innovative Manufacturing Fund (LSIMF) provides up to £520 million for capital investments for the manufacture of human medicines and medical technology, including diagnostics and MedTech products. In the past two years, LSIMF has funded four projects a total of £17 million, which was further supported by £260 million in private investment.

The LSIMF was a successor to two recently closed funds, including: the Medicines and Diagnostics Manufacturing Transformation Fund (MDMTF) which provided £75 million to support the manufacturing of medicines and diagnostics. Alongside the UK Bio-Manufacturing Fund (BMF) which budgeted £38 million for scaling up manufacturing of vaccines and biotherapeutics.

On the Horizon

There are positive developments planned for 2025, despite the challenges of the previous year. The Government's 10-year industrial strategy indicated in its “Invest 2035" Green Paper will drive economic growth and innovation via targeted incentives including:

- A Clean Energy Fund: A significant investment to support the development and deployment of clean energy technologies.

- Innovation Grants: Increased funding for research and development in emerging sectors, including AI, biotechnology, and advanced manufacturing.

- Infrastructure Investment: Allocating funds to improve national infrastructure, including transportation, digital connectivity, and green technologies.

- Skills and Training Programs: Funding to enhance workforce skills, particularly in high-growth and high-tech industries.

- Regional Development Funds: Targeted investments to support economic growth in underdeveloped regions, ensuring balanced national development.

These initiatives are designed to create a sustainable, inclusive, and resilient economy for the future. The specifics of what the investments look like are still being penned but it is likely that £4 billion will be spent supporting heavy industries like automotive & steel. And a further £1.5 billion on the green economy and carbon capture initiatives. To facilitate the government’s core ambition to drive inward private capital, £2 billion is anticipated to be invested in freeports and supply-chain hubs.