Hidden threat to the UK's genomics leadership: addressing the early-stage funding gap

In this blog, Dr Danuta Jeziorska, biotech CEO and industry leader in functional genomics, outlines that the UK has a unique opportunity to lead in genomics and AI-driven precision medicine, but a critical early-stage funding gap—particularly for drug target discovery companies—threatens its global competitiveness.

Genomics and AI is poised to revolutionise precision medicine and patient care by transforming disease prevention, diagnosis, and treatment. The UK, with its rich legacy and steadfast commitment to genomics and leadership in AI innovation, is uniquely positioned to capitalise on the economic, health, and commercial benefits of this revolution. However, a critical funding challenge threatens this progress in UK. While the lack of growth capital affects biotech companies broadly, the early-stage funding gap is particularly acute for drug target discovery companies, which are primarily built on genomics and or AI innovation. Addressing this gap is essential to unlocking the full health and economic potential of the sector and safeguarding the UK's leadership in genomics.

A funding gap for genomics and AI target discovery companies

Early-stage funding is a challenge for many life science companies, but some of the most innovative UK’s companies face a steeper uphill battle, despite their significant value potential. These companies are at the forefront of omics and AI revolution with strong mission to discover novel drug targets to develop precision medicine.

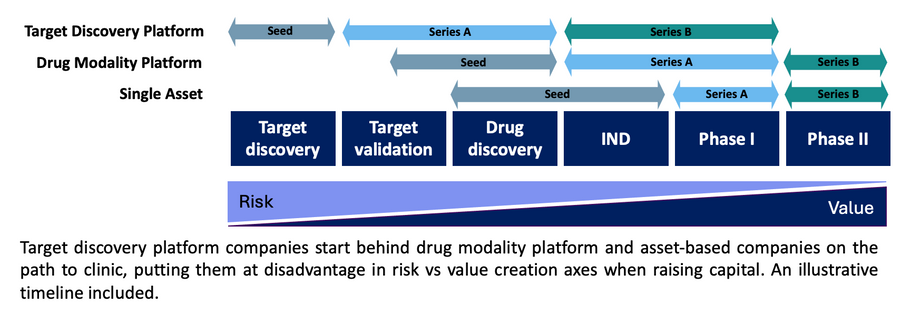

One key reason is the extended timelines for target discovery companies to reach the clinic. Unlike modality discovery (which focus on developing new therapeutic approaches) or asset-based companies (which advance specific drug candidates), target discovery companies begin at the earliest stages of R&D. This requires substantial data generation and years of research, delaying exits and demanding greater patience from investors. Consequently, these companies struggle to compete with asset-focused or modality discovery businesses for the same investor pool.

Moreover, valuing a target discovery platform without tangible assets is a significant hurdle for many venture investors. These companies typically start “pre-target,” making them difficult to assess using traditional biotech investment models, which favor asset-based valuations and clear disease-specific outcomes. As a result, these companies are frequently deemed too early for many UK venture investors at the Series A stage. These investors prefer to wait until the business have de-risked and advanced closer to clinical stage, aligning better with their funding cycles.

In contrast, the highly competitive US venture landscape drives investors to enter earlier and support more ambitious and risky opportunities, as waiting too long might exclude them from future unicorns. US venture investors tend to also inject significantly larger sums at earlier stages. The average US first and second rounds of financing were 1.9 times and 2.2 times higher than for equivalent UK companies at these early stages of the funding journey. This allows companies to expedite their R&D, giving them a competitive edge.

Dr Steve Gardner, CEO of PrecisionLife commented:

Innovating to bring the transformational benefits of genomics and AI to drug discovery and healthcare is a race that requires access to large-scale patient datasets, proprietary analytics platforms, and clinical trial infrastructure. The cost of assembling and training these and getting rapid clinical validation of their results is significant. The UK has not matched the levels of investment available to similar US and Chinese businesses and the competitiveness of UK companies in this sector cannot be maintained without it.

In 2024, UK biotech companies raised £2.06 billion in venture capital, a significant amount but still only 34% of Boston’s £6.05 billion, and 10.6% of the US total of £19.5 billion. This disparity places UK companies at a disadvantage in terms of capital access, valuations, and competitive potential, compared to their well-funded US counterparts.

As Emma Johnson, Senior Investment Manager, Direct & Co-Investments, British Patient Capital, put it:

The portion of the UK’s share of global VC investment that is received by the life sciences sector has not changed in the last 10 years. To try and change this, British Patient Capital is investing into sector-specialist investment managers and directly into start-ups in areas of UK strengths such as genomics, AI tools for precision medicine, drug discovery and development.

Beyond funding amounts, cultural differences and a limited pool of UK investors further widens the gap. The US benefits from a larger, more diverse, and competitive investor base, driving early support for innovative ideas to not lose out on the opportunities. Meanwhile, the UK’s relatively risk-averse venture market exacerbates the funding challenges for early-stage target discovery companies.

The impact of this disparity is evident: of the 50 most valuable biotech companies founded in the last 15 years, only three were established outside the US, and none in the UK. This highlights a missed opportunity for the UK to attract investment and compete on the global stage. Closing this early-stage funding gap is essential to unlocking the sector's potential.

High-value potential of target discovery companies utilising genomics & AI

There is a significant unmet need for new medicines to provide effective treatments for patients suffering from devastating diseases. Current drug discovery faces a success rate of less than 10%, partially due to an incomplete understanding of disease biology. Targets supported by genetic evidence have been shown to double the probability of reaching market approval, making them highly attractive for therapeutic development. The use of genomics and AI can address these challenges by enhancing our understanding of disease mechanisms and uncovering novel, differentiated drug targets, causal to disease biology, with corresponding biomarkers for patient stratification.

Companies focusing on first-in-class targets with genetic evidence have demonstrated potential for lucrative value. The platform-based nature of many genomics companies further reduces investment risk by eliminating a single point of failure and offering multiple partnering opportunities. However, pharmaceutical companies often expect validated targets as proof of concept before partnering, which can limit a company’s ability to generate early-stage revenue. Despite this, several high-value agreements have been successfully closed in recent years.

Notably, Relation Therapeutics entered a collaboration with GSK to develop new treatments for osteoarthritis and fibrotic diseases, with a deal worth up to $300 million. Similarly, Verge Genomics partnered with Alexion, AstraZeneca Rare Disease, in a deal valued at up to $840 million to identify novel drug targets for rare neurodegenerative and neuromuscular diseases. These collaborations underscore the high-value potential of target discovery companies utilising genomics and AI, highlighting their significant role in the future of precision medicine.

The need for change and a path forward

To fully harness the potential of the UK's genomics and AI sector, it's imperative to address the early-stage funding challenges faced by target discovery companies. General strategies to enhance the UK's investment ecosystem are underway, such as increasing cross-border investor collaboration, diversifying the UK investor pool, mobilizing more capital into science and technology sectors (like the Long-term Investment for Technology and Science (LIFTS) and pension reforms), and cultivating a risk-tolerant investment culture. However, these measures may not sufficiently address the unique needs of target discovery companies, posing an imminent threat to the sector.

Specific strategies for target discovery companies to level the playing field with modality discovery and asset-focused peers by enabling platform targets with proof of concept by Series A include:

- Targeted governmental grants: Current grant funding mechanisms often fall short for genomics, AI and data-driven target discovery companies, as they are designed more for translation, rather than to support the extensive data generation and platform built at early stages. Introducing grants specifically tailored for early-stage target discovery companies would enable them to advance toward proof of concept using non-dilutive capital.

- Translational funds in academia: nurturing target discovery companies for longer in academic settings through translational funds can help bridge the gap to commercialization. However, the slower pace and limited commercial experience within academia could hinder progress compared to faster US counterparts. This approach may not fully address the funding needs of non-academic spinouts, which make up the majority of UK genomics companies.

- Establishing a dedicated UK genomics fund: Creating a specialized fund with expertise in commercializing target discovery platform-based technologies, coupled with robust risk management and substantial patient capital, can accelerate development to proof of concept during the seed stage.

By implementing these targeted strategies alongside broader investment ecosystem enhancements, the UK can effectively bridge the early-stage funding gap for target discovery companies, driving advancements that benefit both patients and the economy.