One year later: How UK biotech survived SVB collapse

Looking back

Written by Melanie Senior, based on materials and reports provided by BIA and associates. Melanie is a biopharmaceutical science, strategy, investment and market access writer for Nature Biotechnology, Evaluate Pharma and IN VIVO.

Chaos in California

The trouble began as anxious customers of California-headquartered Silicon Valley Bank (SVB) began to withdraw tens of billions of dollars of deposits during the second week of March 2023. SVB, wracked by high interest rates and underperforming bond investments, had announced an emergency stock sale. Almost overnight, one of the tech and biotech sector’s most popular loan and deposit account providers went sour. Several other banks – Signature, First Republic and Credit Suisse - were spoilt in its wake.

SVB was placed into receivership on the morning of Friday, 10 March. That action, thousands of miles away, triggered one of UK biotech’s most hair-raising weekends.

Just before midnight UK time on Friday, the Bank of England (BoE) announced that SVB UK would be placed into insolvency. SVB UK, it declared, “has no critical functions” supporting the financial system and a “limited presence in the UK”. Eligible depositors would be paid out up to the £85,000 protected limit.

We have a big problem

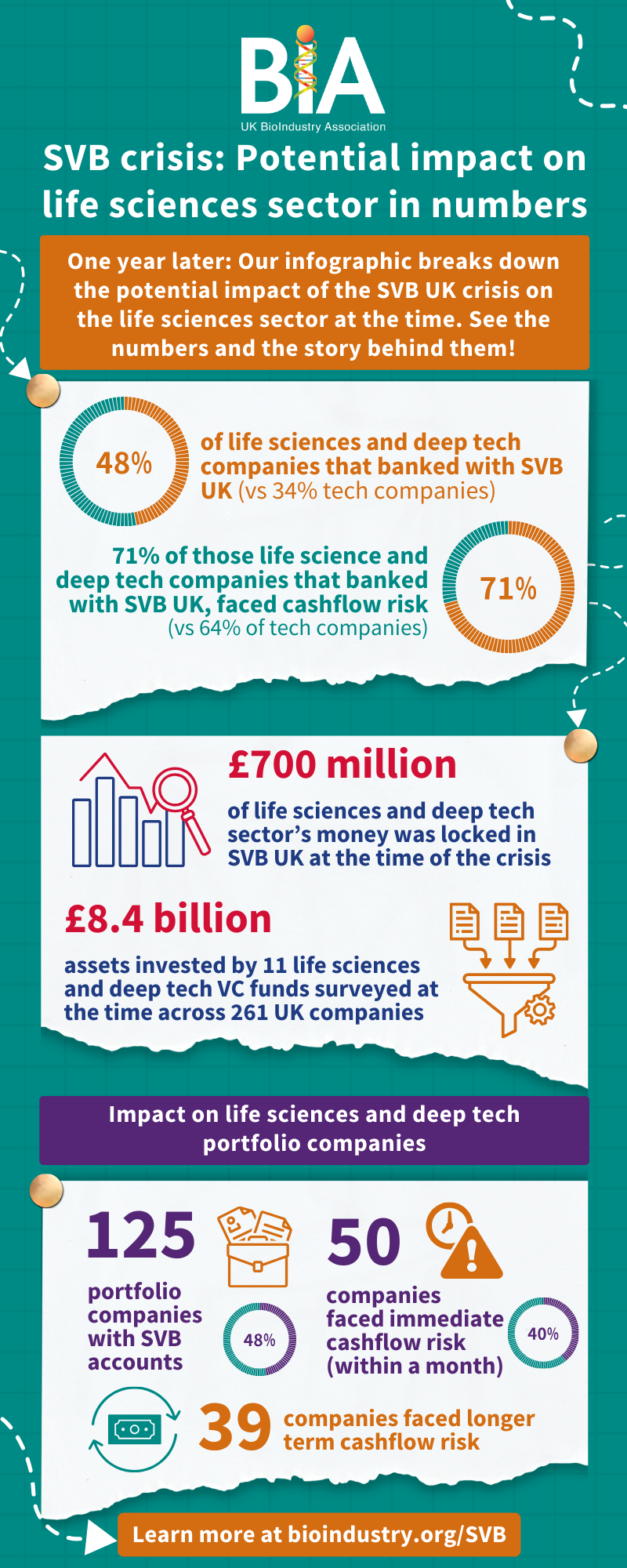

At 8.30 am on Saturday, 11 March, BIA’s CEO Steve Bates called the Treasury (HMT). Officials were told, in no uncertain terms, that this problem was big. Very big.

At least four biotech boards, compelled by Directorial duties, were discussing whether to cease trading on Monday. Employee payrolls were under threat. So was R&D: one biotech looked at cancelling a clinical trial contract to recoup cash.

Solution: Major UK bank steps in

A brighter Sunday

On Sunday morning, the chancellor, speaking on Sky News, mentions “tech and life sciences” during remarks about the SVB collapse.

At 8 am, a new Treasury statement materialises. The issue is “high priority”, and a solution to avoid or minimise damage to “some of our most promising UK companies” is being worked on “at pace”. Importantly, there are “immediate plans to ensure the short-term operational and cashflow needs of SVB UK’s customers are able to be met.”

BIA keeps its members informed throughout a nervous Sunday. Mediation fills the afternoon: BIA implores VCs not to take their money out in the event of an HSBC rescue. VCs reassure BIA. BIA reassures HBSC that buying SVB UK is, therefore, a good idea.

Dan recalls ‘palpable relief and joy’ (and the popping of at least one bottle of breakfast champagne) on a BIA team Zoom call.

UK biotechs have new HSBC accounts. Congratulations circulate: BIA to the government, public officials to BIA and its network for its role in solving the crisis. Dan Mahony and Sir Jon write to BoE governor Andrew Bailey and his team acknowledging the role of their “swift and decisive leadership” in averting long-lasting damage.

The solution achieved, they added, may even have placed the sector “in a stronger position than before.”

Lessons learned

Interested in joining BIA as a member?

Learn more about BIA membership and if you have any questions, please get in touch with: