The National Security and Investment Act, passed by Parliament in May 2021, gave the UK Government new powers to scrutinise and intervene in investments and business transactions, both foreign and domestic, where necessary to protect national security.

The BIA worked with government, parliamentarians and members to ensure the regime works in the interest of British businesses, and that the concerns that many life science companies had about the new measures were properly understood and addressed by the Government.

The BIA has produced a resource hub for members to better understand their obligations under the new law and to answer key questions about the regime, found here. To read more about our involvement during the development of the National Security and Investment regime, and how we have worked to protect the life science sector from potential negative impact, click below.

What is the NSI Regime?

This page provides an overview of the new National Security and Investment regime, what transactions it applies to, how it will work in practice and the penalties for not following it.

We will update this page as more information and resources become available. This content is based on the drafting of the legislation as of August 2021, and may be subject to change. This is for information purposes only, it is not intended to be legal advice, and should not be used as such.

Summary of the National Security and Investment regime

The National Security and Investment (NSI) regime is the UK Government’s new approach to scrutinising and intervening in business transactions, both foreign and domestic, where necessary to protect national security. It gives the Government the powers to screen investments and carry out national security assessments of certain transactions, before or after they take place.

The regime came into force in the UK on 4 January 2022, and will apply to transactions that have taken place on or after 12 November 2020.

It establishes a mandatory requirement for investors, or other acquiring entities, proposing investments in a defined sensitive sector of the economy to notify the Department for Business, Energy and Industrial Strategy (BEIS) ahead of the transaction taking place.

It will be managed and carried out by the new Investment Security Unit within BEIS, with the scrutiny powers being conferred on the Secretary of State for BEIS.

Transactions this applies to

Mandatory notification is required ahead of transactions where an investor gains control in an entity, meaning the acquisition of more than 25%, 50% or 75% of shares or voting rights in an entity, or can stop or pass any form of resolution in an entity.

This applies to acquisitions in one of the 17 sensitive sectors of the economy as set out by the Government, which includes Synthetic Biology and Artificial Intelligence.

Impact on UK life sciences

The Government has identified Synthetic Biology as a sector which requires mandatory notification of transactions to assess the potential risk to national security.

Activities within the Synthetic Biology sector which fall under this regime currently include, but are not limited to:

- Carrying out basic scientific research into synthetic biology.

- The development of synthetic biology.

- The formulation of synthetic biology to enable the degradation of materials.

- The provision of services that enable the activities listed above.

Despite the list of exemptions in the definition, it is the BIA’s view that the definition still has the potential to capture most companies in this sector, the vast majority of which have no implication on national security. By placing these additional burdens on a sector that is heavily reliant on foreign investment to carry out its pioneering work, it risks hindering investment to the UK life sciences industry.

Investment Security Unit

The Investment Security Unit (ISU) within BEIS is responsible for operating the NSI regime, identifying, addressing and mitigating national security risks to the UK when certain transactions take place. The Secretary of State for BEIS oversees the ISU and has the ultimate decision-making authority.

Ahead of the regime coming into force, investors can have informal discussions with the ISU to determine whether a transaction would fall within the scope of the regime. Businesses can also get advice on what to expect from the regime to assist in business planning by emailing [email protected]. Find out more about the Investment Security Unit here.

Mandatory vs. voluntary notifications

Acquisitions in the sensitive sectors of the economy that meet the control thresholds are subject to mandatory notification ahead of the transaction taking place. Such acquisitions must gain clearance from the ISU before proceeding, and if no notification is submitted, the transaction will be void. It is the responsibility of the acquirer to submit the notification.

Investors who are carrying out acquisitions in other sectors but fear their acquisition may be considered to have an impact on national security can make a voluntary notification to the ISU. This follows the same process, explained below. As the ISU has the power to investigate all investments in any sector which could impact national security up to five years after they take place, the voluntary notification system can be used to provide certainty that the transaction will not be investigated in the future.

Notification process

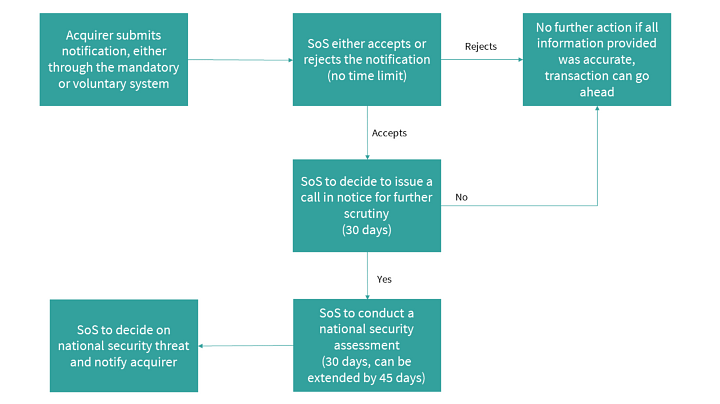

The investor must submit a notification if the transaction falls within the mandatory regime, or can submit a voluntary notification if it is outside this.

After the notification is submitted, the ISU must decide whether to accept the notification for further scrutiny, or reject it and allow the transaction to continue. There is no time restriction for this. Once the notification is accepted to pursue further, the ISU has a maximum of 30 days to decide whether to call-in the transaction for a national security assessment.

If the ISU doesn’t need to call-in the transaction, the investment can be pursued. If it is decided that there may be a national security concern, a national security assessment is carried out.

The ISU has up to 30 working days to complete this, but can extend this time by a further 45 working days and take any action it considers necessary and proportionate to address any national security risk. During this time, it can require businesses and investors to provide information relevant to the transaction. For voluntary notifications, businesses and investors can continue to progress the transaction during the assessment period, unless the ISU orders otherwise. Transactions subject to mandatory notification must not complete the transaction until clearance is given.

The ISU then decides whether the transaction can go ahead or not. This decision is final and cannot be revisited unless false or misleading information has been provided.

The Secretary of State also has the power to call-in investments in any sector that could give rise to national security concerns. This reserve call-in power can be used up to five years after the transaction takes place, so long as the Secretary of State takes action within six months of being made aware of the transaction. Being made aware of the transaction could be by reading about it in the newspaper, for example, or via voluntary notification.

Penalties

There are significant penalties for failure to comply with the regime. Transactions that take place without going through the mandatory notification system where required will be declared void. A company can be fined the higher of £10 million or up to 5% of worldwide turnover for completing a notifiable acquisition without clearance or for failing to comply with an order. Directors may also face up to five years in prison.

There is no penalty associated with not submitting voluntary notifications, unless orders are not complied with.

NSI Regime FAQs

This page answers some common questions about the new National Security and Investment (NSI) regime and seeks to provide clarity for both businesses and investors on what to expect. An overview of the regime is a useful place to start when trying to understand the new measures.

All content is informative, is not intended to be legal advice, and should not be used as such. It is based on the legislation as currently drafted, is correct as of August 2021 and may be subject to change.

Why is the UK Government bringing in this change?

The current mechanism for investigating national security was established by the Enterprise Act 2002, which gave the Competition and Markets Authority the power to intervene on mergers on grounds of national security if certain tests are met. It is felt that this does not go far enough, and technological developments have further widened the potential scope of national security concerns. Similar national security regimes are in place in France, Germany, USA and Japan.

What is the definition of a national security interest?

The UK Government, despite facing calls to do so, has decided not to define “national security interest” in legislation to ensure it is able to address future risks which are not yet a concern.

Does this only apply to life sciences companies?

The mandatory notification regime also applies to advanced materials, advanced robotics, artificial intelligence, civil nuclear, communications, computing hardware, critical supplies to government, critical suppliers to emergency services, cryptographic authentication, data infrastructure, defence, energy, military and dual-use, quantum technologies, satellite and space technologies, synthetic biology and transport.

How will this impact investment in UK life sciences and higher education?

It is too early to know what impact the new regime will have on investment into these sectors. By classifying Synthetic Biology as a sensitive sector, many investments into the sector will need to go through the screening process ahead of taking place, even if there is no real impact on national security. If the assessment process is not efficient, it could delay investments and could potentially make the UK a less attractive place to invest. The BIA is working to mitigate this risk.

The potential impact of this regime on higher education research is not considered to be too substantial. The Government will shortly be producing guidance specifically for the higher education and research sector to outline how it may be impacted by the regime.

Is this only for foreign investment?

No, the regime is targeted at foreign and domestic acquisitions into companies based in the UK, and those with headquarters abroad but carrying out activities in the UK.

Who will review transactions?

The Department for Business, Energy and Industrial Strategy (BEIS) is responsible for the operation of this regime, and has set up the Investment Security Unit (ISU) to process transactions. The ultimate responsibility for decision making sits with the Secretary of State for BEIS. The ISU will be made up of civil servants carrying out the assessments, operating a hub-and-spoke model across government departments to benefit from the range of industry expertise from across the civil service. For example, the National Security and Investment team at the Foreign Office will support the ISU its assessments of foreign investments.

When does this apply from?

While the regime will come into force on 4 January 2022, it will apply to transactions taking place on or after 12 November 2020. This was when the bill setting out the regime was introduced to Parliament. The regime applies from then to ensure potentially problematic transactions are not rushed through before the regime becomes operational.

How long will the scrutiny process take?

Once the mandatory notification has been submitted it must be accepted by BEIS, there is no time restriction for this but it is intended to be a matter of days. Once accepted, the ISU has 30 working days to carry out the initial assessment. If it chooses to call-in the investment for a national security assessment after this, it has a further 30 working days to carry this out, though this can be extended to 45 working days.

What is a “trigger event”?

A “trigger event” is when an individual gains control of a qualifying entity or asset. This is the transaction which requires a notification to be made under the mandatory notification process if control over an entity is gained. For control of assets, this could be alerted to the ISU through the voluntary notification process, or be subject to the ISU retrospectively investigating the transaction. Gaining control of a qualifying entity includes:

- The acquisition of more than 25%, 50% or 75% of shares or voting rights in an entity, or can stop or pass any form of resolution in an entity.

- Material influence over an entity.

If an individual acquires a right or interest in an asset and is able to use the asset or director or control how the asset is used, this forms part of the voluntary notification regime. Qualifying assets include:

- Land,

- Tangible (or, in Scotland, corporeal) moveable property,

- Ideas, information or techniques which have industrial, commercial or other economic value (this includes trade secrets, databases, source code, algorithms, formulae, designs, plans and drawings, and software).

My transaction is taking place before the regime comes into force. Will this be subject to scrutiny?

The regime applies to all applicable transactions in the sensitive sectors and meeting the control thresholds that have taken place on or after 12 November 2020.

Are there penalties for failing to notify if notification is not mandatory?

No, penalties only apply in situations where transactions subject to mandatory notification were not alerted to the Government. Penalties for failure to comply with the regime include fines the higher of £10 million or up to 5% of worldwide turnover. Directors may also face up to five years in prison.

Will this be used for other economic reasons, like preventing monopolies or protecting jobs?

During debates on the legislation introducing the new regime in the Houses of Parliament, the Government has repeatedly insisted that this regime would be exclusively focused on national security, and it would not be used for wider public interest considerations.

If investment is blocked, is there any provision for compensation?

Investments will be blocked if it is deemed that they risk national security. Such transactions will be declared void, and no compensation will be provided.

BIA Resources

External resources

- UK Government: National Security and Investment Act 2021

- UK Government: statement on the use of powers to call in acquisitions

- UK Government: Overview of the National Security and Investment Bill factsheet

- UK Government: The National Security and Investment Regime: process for businesses factsheet

- UK Government: Prepare for new rules about acquisitions

- UK Government: Sector definitions statutory instrument

- UK Government: NSI and people or acquisitions outside of the UK

- UK Government: NSI alongside regulatory requirements

- UK Government: Higher education and research-intensive sectors

- Covington & Burling LLP: briefing paper on the National Security and Investment Bill